Trading Systems: What Is A Trading System?

A trading system is simply a group of specific rules, or parameters, that determine entry and exit points for a given equity. These points, known as signals, are often marked on a chart in real time and prompt the immediate execution of a trade.

Here are some of the most common technical analysis tools used to construct the parameters of trading systems:

Often, two or more of these forms of indicators will be combined in the creation of a rule. For example, the MA crossover system uses two moving average parameters, the long-term and the short-term, to create a rule: "buy when the short-term crosses above the long term, and sell when the opposite is true." In other cases, a rule uses only one indicator. For example, a system might have a rule that forbids any buying unless the relative strength is above a certain level. But it is a combination of all these kinds of rules that makes a trading system.

Because the success of the overall system depends on how well the rules perform, system traders spend time optimizing in order to manage risk, increase the amount gained per trade and attain long-term stability. This is done by modifying different parameters within each rule. For example, to optimize the MA crossover system, a trader would test to see which moving averages (10-day, 30-day, etc.) work best, and then implement them. But optimization can improve results by only a small margin - it’s the combination of parameters used that will ultimately determine the success of a system.

Advantages

So, why might you want to adopt a trading system?

Disadvantages

We've looked at the main advantages of working with a trading system, but the approach also has its drawbacks.

Do They Work?

There are a number internet scams related to system trading, but there are also many legitimate, successful systems. Perhaps the most famous example is the one developed and implemented by Richard Dennis and Bill Eckhardt, who are the Original Turtle Traders. In 1983, these two had a dispute over whether a good trader is born or made. So, they took some people off the street and trained them based on their now-famous Turtle Trading System. They gathered 13 traders and ended up making 80% annually over the next four years. Bill Eckhardt once said, "anyone with average intelligence can learn to trade. This is not rocket science. However, it is much easier to learn what you should do in trading than to do it." Trading systems are becoming more and more popular among professional traders, fund managers and individual investors alike - perhaps this is a testament to how well they work.

Dealing with Scams

When looking to purchase a trading system, it can be difficult to find a trustworthy business. But most scams can be spotted by common sense. For example, a guarantee of 2,500% yearly is clearly outrageous as it promises that with only $5,000 you could make $125,000 in one year ... and then through compounding for five years, $48,828,125,000! If this were true, wouldn't the creator trade his or her way to becoming a billionaire?

Other offers, however, are more difficult to decode, but a common way to avoid scams is to seek out systems that offer a free trial. That way you can test the system yourself. Never blindly trust the the business boasts about! It is also a good idea to contact others that have used the system, to see whether they can affirm its reliability and profitability.

Conclusion

Developing an effective trading system is by no means an easy task. It requires a solid understanding of the many parameters available, the ability to make realistic assumptions and the time and dedication to develop the system. However, if developed and deployed properly, a trading system can yield many advantages. It can increase efficiency, free up time and, most importantly, increase your profits.

Next: Trading Systems: Designing Your System - Part 1

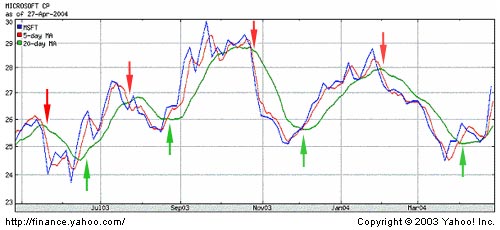

Often, two or more of these forms of indicators will be combined in the creation of a rule. For example, the MA crossover system uses two moving average parameters, the long-term and the short-term, to create a rule: "buy when the short-term crosses above the long term, and sell when the opposite is true." In other cases, a rule uses only one indicator. For example, a system might have a rule that forbids any buying unless the relative strength is above a certain level. But it is a combination of all these kinds of rules that makes a trading system.

|

| MSFT Moving Average Cross-Over System Using 5 and 20 Moving Averages |

Because the success of the overall system depends on how well the rules perform, system traders spend time optimizing in order to manage risk, increase the amount gained per trade and attain long-term stability. This is done by modifying different parameters within each rule. For example, to optimize the MA crossover system, a trader would test to see which moving averages (10-day, 30-day, etc.) work best, and then implement them. But optimization can improve results by only a small margin - it’s the combination of parameters used that will ultimately determine the success of a system.

Advantages

So, why might you want to adopt a trading system?

- It takes all emotion out of trading - Emotion is often cited as one of the biggest flaws of individual investors. Investors who are unable to cope with losses second guess their decisions and end up losing money. By strictly following a pre-developed system, system traders can forgo the need to make any decisions; once the system is developed and established, trading is not empirical because it is automated. By cutting down on human inefficiencies, system traders can increase profits.

- It can save a lot of time - Once an effective system is developed and optimized, little to no effort is required by the trader. Computers are often used to automate not only the signal generation, but also the actual trading, so the trader is freed from spending time on analysis and making trades.

- It’s easy if you let others do it for you - Need all of the work done for you? Some companies sell trading systems that they have developed. Other companies will give you the signals generated by their internal trading systems for a monthly fee. Be careful, though - many of these companies are fraudulent. Take a close look at when the results they boast about were taken. After all, it’s easy to win in the past. Look for companies that offer a trial, which lets you test out the system in real-time.

Disadvantages

We've looked at the main advantages of working with a trading system, but the approach also has its drawbacks.

- Trading systems are complex - This is their biggest drawback. In the developmental stages, trading systems demand a solid understanding of technical analysis, the ability to make empirical decisions and a thorough knowledge of how parameters work. But even if you are not developing your own trading system, it's important to be familiar with the parameters that make up the one you are using. Acquiring all of these skills can be a challenge.

- You must be able to make realistic assumptions and effectively employ the system - System traders must make realistic assumptions about transaction costs. These will consist of more than commission costs - the difference between the execution price and the fill price is a part of transaction costs. Bear in mind, it is often impossible to test systems accurately, causing a degree of uncertainty when bringing the system live. Problems that occur when simulated results differ greatly from actual results are known as "slippage". Effectively dealing with slippage can be a major roadblock to deploying a successful system.

- Development can be a time-consuming task - A lot of time can go into developing a trading system to get it running and working properly. Devising a system concept and putting it into practice involves plenty of testing, which takes a while. Historical backtesting takes a few minutes; however, back testing alone is not sufficient. Systems must also be paper traded in real time in order to ensure reliability. Finally, slippage may cause traders to make several revisions to their systems even after deployment.

Do They Work?

There are a number internet scams related to system trading, but there are also many legitimate, successful systems. Perhaps the most famous example is the one developed and implemented by Richard Dennis and Bill Eckhardt, who are the Original Turtle Traders. In 1983, these two had a dispute over whether a good trader is born or made. So, they took some people off the street and trained them based on their now-famous Turtle Trading System. They gathered 13 traders and ended up making 80% annually over the next four years. Bill Eckhardt once said, "anyone with average intelligence can learn to trade. This is not rocket science. However, it is much easier to learn what you should do in trading than to do it." Trading systems are becoming more and more popular among professional traders, fund managers and individual investors alike - perhaps this is a testament to how well they work.

Dealing with Scams

When looking to purchase a trading system, it can be difficult to find a trustworthy business. But most scams can be spotted by common sense. For example, a guarantee of 2,500% yearly is clearly outrageous as it promises that with only $5,000 you could make $125,000 in one year ... and then through compounding for five years, $48,828,125,000! If this were true, wouldn't the creator trade his or her way to becoming a billionaire?

Other offers, however, are more difficult to decode, but a common way to avoid scams is to seek out systems that offer a free trial. That way you can test the system yourself. Never blindly trust the the business boasts about! It is also a good idea to contact others that have used the system, to see whether they can affirm its reliability and profitability.

Conclusion

Developing an effective trading system is by no means an easy task. It requires a solid understanding of the many parameters available, the ability to make realistic assumptions and the time and dedication to develop the system. However, if developed and deployed properly, a trading system can yield many advantages. It can increase efficiency, free up time and, most importantly, increase your profits.

Next: Trading Systems: Designing Your System - Part 1

ไม่มีความคิดเห็น:

แสดงความคิดเห็น